Over a decade of experience in investment management and capital markets

Projects showcase: investment management and capital markets

Modernising a Digital Platform for a Major British Financial Services Provider

We partnered with a prominent British technology-led services and payments company to modernise their digital platform, which serves 4 million individual stockholders. The platform enables users to build investment portfolios, enrol in Direct Stock Purchase Plans and Employee Plans, and access eDelivery of statements, among other features.

Our team rebuilt the user-facing frontend application, implemented updated user journeys, and ensured a mobile-friendly experience. The multi-layered project was completed in two-week sprints, and the platform was launched into production using a phased approach.

Alpha capture and market simulation platform for a global quantitative hedge fund

Global quantitative investment manager Man AHL, a pioneer in systematic trading, collaborated with our team to redesign and redevelop their secure extranet and market simulation system.

The project involved reimagining the UI, streamlining workflows, enhancing usability, adding new features, and rebuilding the platform on a new framework. A robust Python-based backend served as middleware, integrating the user-facing extranet with Man AHL’s internal systems.

Customer testimonial: Solum Financial (United Kingdom)

Cloud-based Valuation & Risk Modelling Platform for Derivatives

We collaborated with London City-based Solum Financial to develop a cloud-based derivatives valuation and risk modelling platform. Our work included refining specifications, designing a user-friendly interface, and overseeing delivery, testing, deployment, and support.

Now offered as SaaS to global financial institutions and enterprises, the platform integrates with OpenGamma Strata, an open-source analytics and market risk library, delivering capabilities like pricing, analytics, curve calibration, scenario evaluation, trade modelling, and market data representation.

Enhancing Trade Execution Middleware for a Leading Quantitative Investment Manager

We collaborated with Man AHL’s Central Trade Execution team, responsible for overseeing $5 trillion in annual trades, to undertake a significant infrastructure migration and key core system enhancements.

Over 2.5 years, three of our software engineers expanded and refactored the trade execution middleware. This included implementing an OMS connector to Bloomberg EMS and developing a new FIX connector to Bloomberg within the extensive OMS codebase. The project was completed ahead of schedule, leaving the codebase significantly more robust than before.

Delivering a new DXM Solution for Vontobel: Swiss Asset Manager with CHF 120bn AUM

Vontobel Asset Management, a global multi-boutique firm, engaged us to migrate their product and marketing information portal to a new Digital eXperience Management (DXM) platform.

With over 440 employees across 17 locations, Vontobel serves pension funds, banks, insurance companies, and asset managers. Our implementation involved setting up the new DXM platform, integrating multiple backends, and developing bespoke financial data distribution and access management features to ensure efficient presentation and distribution of product-related information.

Messaging Hub for a Global Top 3 Stock Exchange: Support and Development

Metasite took over the support and development of a vital messaging hub application for a Global Top 3 Stock Exchange. Initially developed by another supplier, the messaging hub managed regional market fund transfers using message queues, routing messages from multiple participants to consumers such as pension funds.

Our team has provided ongoing support for the hub, addressing application improvements driven by regulatory changes and downstream feature support (e.g. new SWIFT features). We also handle incident resolutions and support for the Exchange’s Ops team.

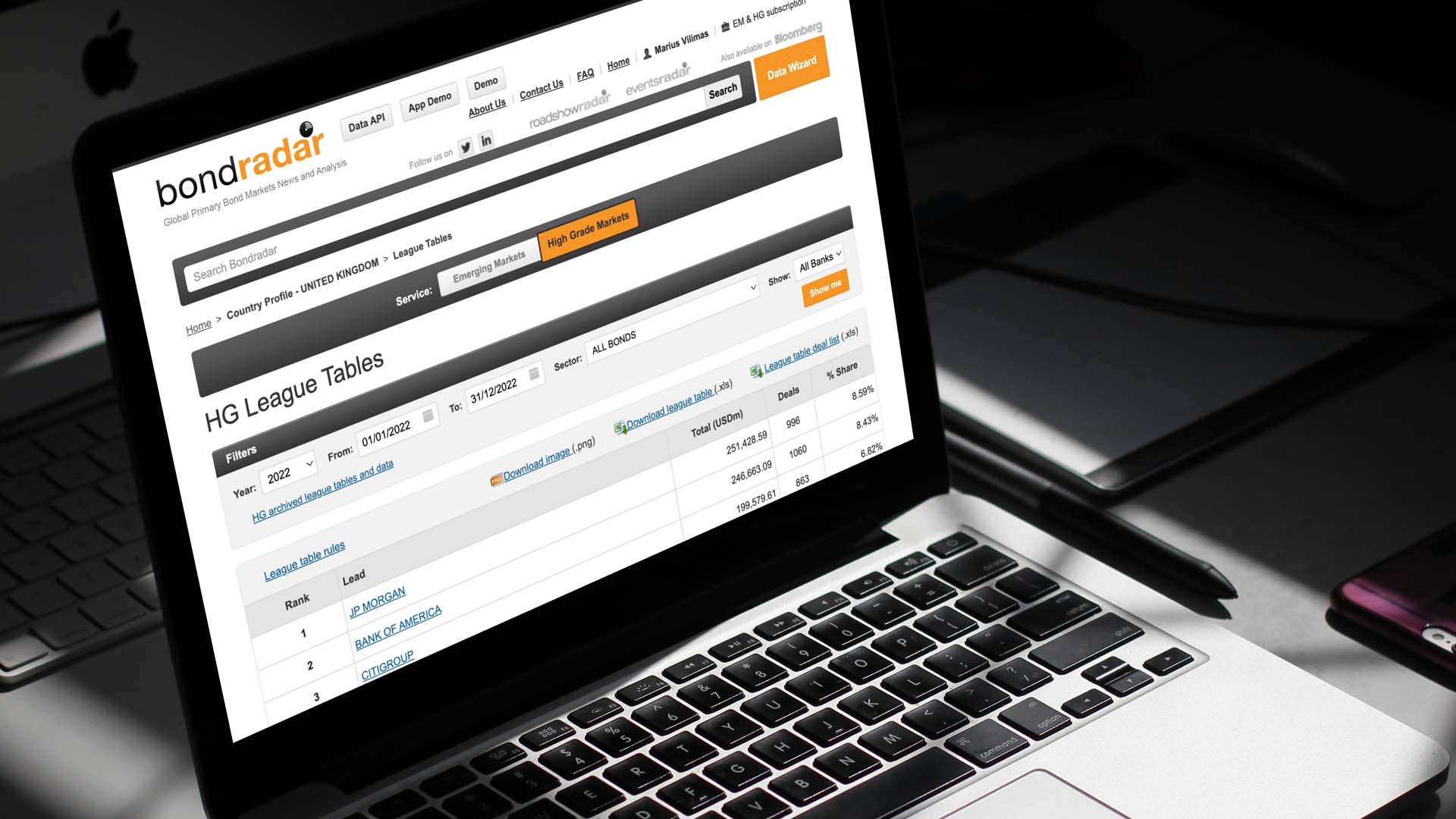

Empowering Bond Radar: Global Primary Bond Market News & Analysis

We have been partnering with London-based BondRadar, a real-time news service for international bond markets, since 2002. As their go-to technology provider, our engineering team has been responsible for developing and maintaining their web platforms, custom Bloomberg integration, mobile apps, and REST API.

This ongoing 20-year collaboration has seen the continuous addition and refinement of features for Bond Radar, Loan Radar, and other related services, ensuring optimal performance and accuracy for major financial institutions engaged in the capital markets.

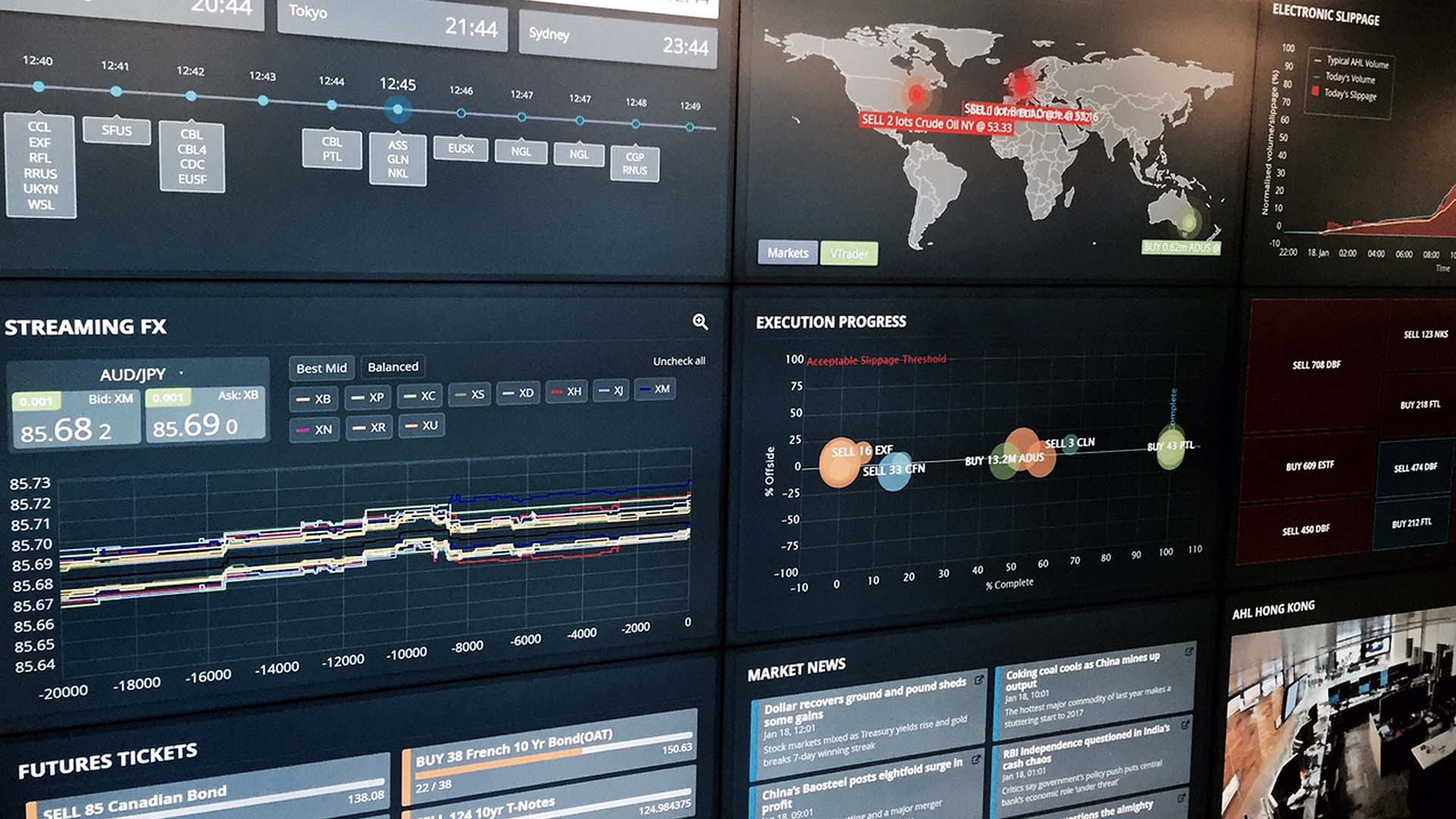

Real-Time Trade Execution Performance Visualisation Dashboard for Man Group

Man Group, the world’s largest publicly-listed hedge fund manager, commissioned us to develop a bespoke real-time trading performance visualisation dashboard for their systematic trading division, Man AHL. Displayed on a giant floor-to-ceiling screen at their London HQ, the modular, browser-based dashboard enables real-time visualisation of trade execution data.

The admin panel also developed by our team allows the creation and customisation of data visualisation widgets, which can be selected and arranged on configurable dashboards for optimal display and usability.

TCO Reduction & Migration for Man Group’s Global Collection of Portals

We collaborated with Man Group to rebuild their global online platform, encompassing 30+ country-specific websites and various management systems. By leveraging an open-source content management framework and custom functionalities, we enhanced usability, performance, and reduced the overall total cost of ownership.

The new platform resulted in significant maintenance cost reduction, faster production releases, improved backup infrastructure switch time, real-time data synchronization, and increased flexibility for future developments.

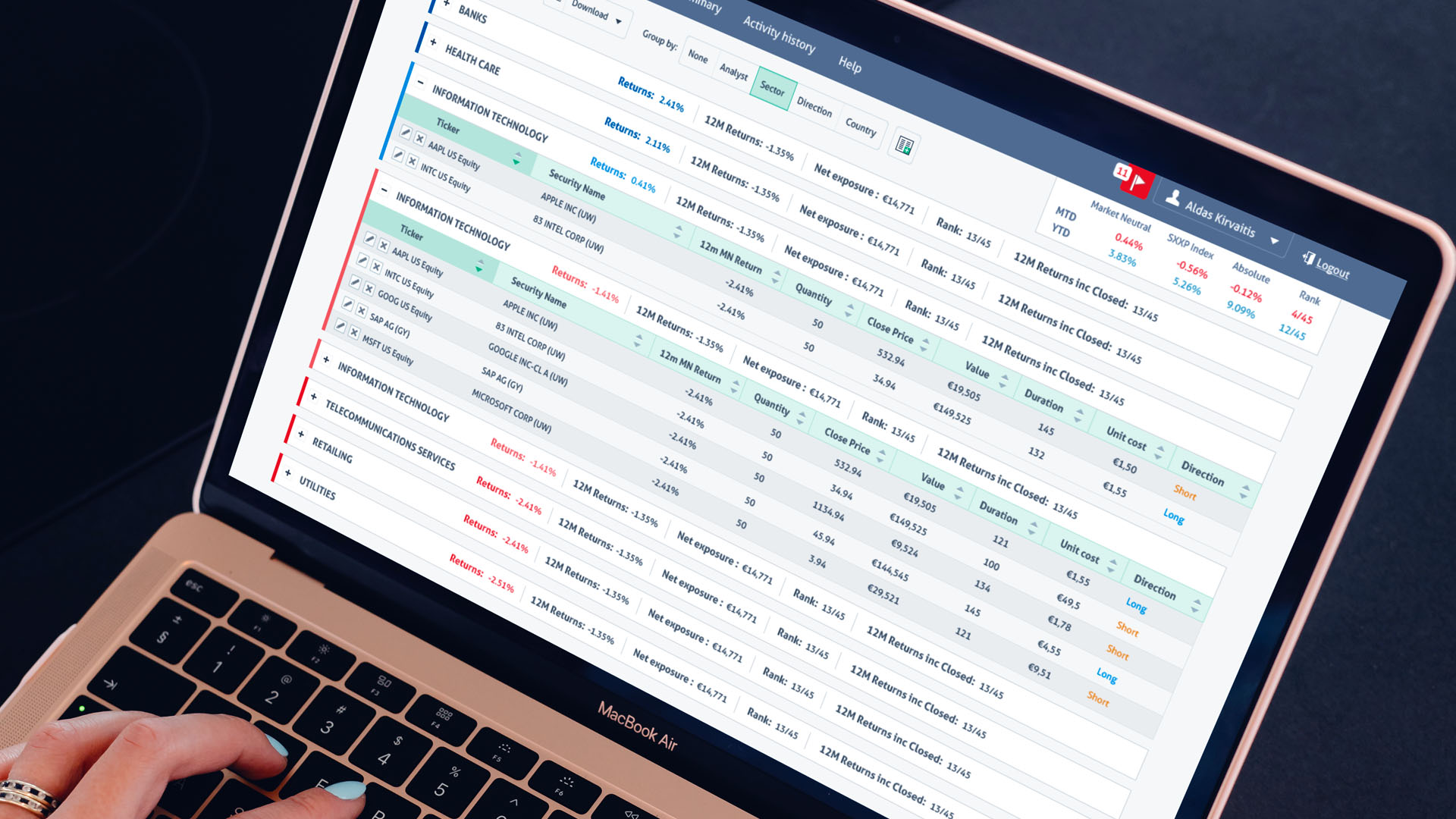

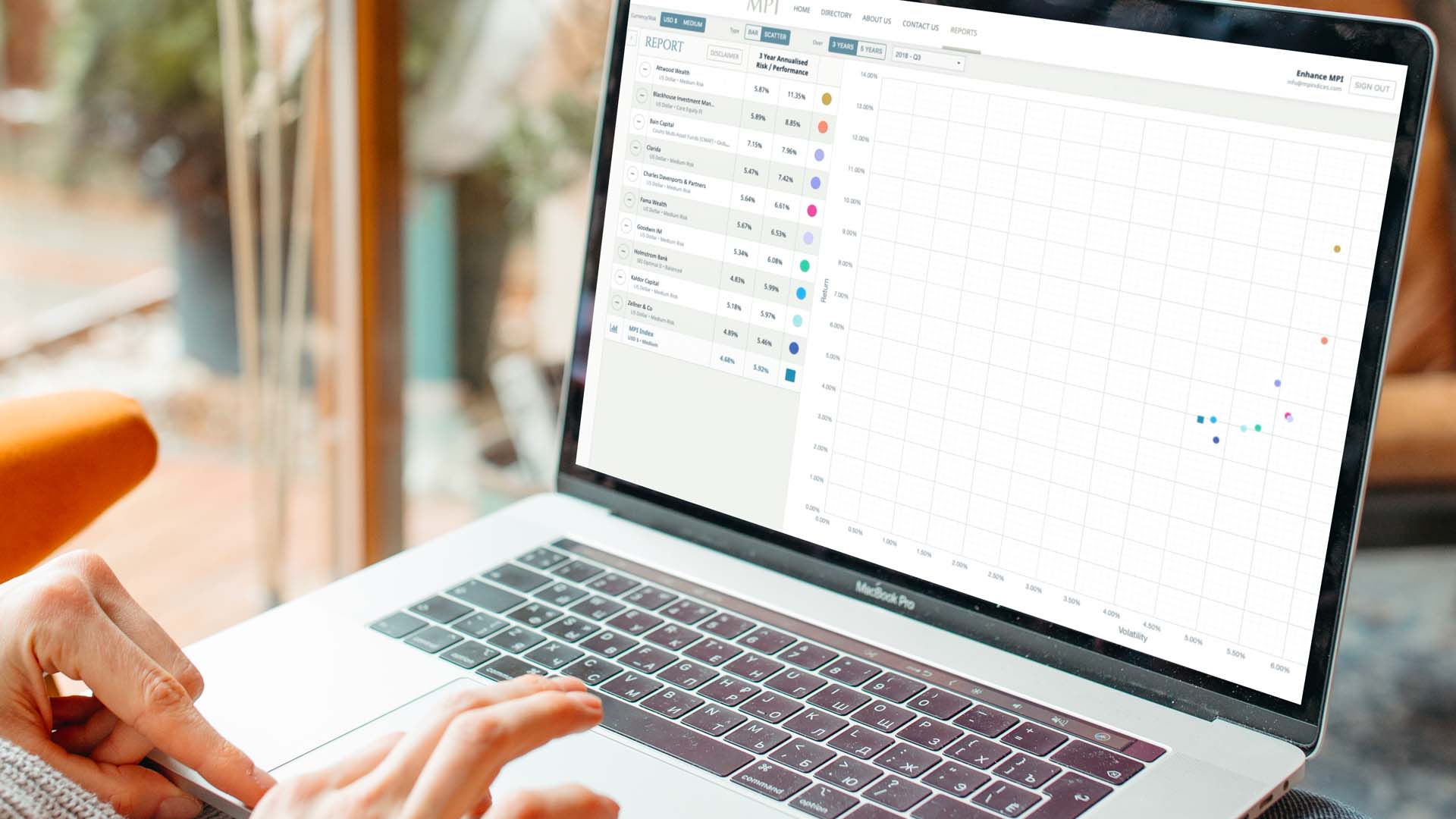

Investment Manager Performance & Risk Platform Used by 300 Trust and Advice Firms

We developed a digital service for a London-based client, connecting advisors and wealth managers by providing performance benchmarks for portfolios managed in a fiduciary capacity.

The platform features an aggregated investment manager web UI, acting as a hub for finding, comparing, and selecting discretionary managers for clients. With dozens of contributors from Europe, North America, and Southeast Asia, the platform enables in-depth performance analysis, visual comparisons, a directory of managers and investment strategies, and portfolio data analytics.

Blockchain-Based Green Energy Exchange MVP for WePower: Connecting Producers and Users

WePower, a distributed energy exchange platform (DApp), sought Metasite’s expertise to design and build their MVP. Our team developed the architecture and a fully functional prototype, enabling WePower to raise $40 million in funding.

The platform relied on Ethereum blockchain for secure transactions and kWh token ownership, smart contracts for business logic, and the Metamask Chrome plugin for direct user connections without third-party involvement. WePower has since tokenized an entire EU country’s national grid and opened up the direct PPA market in Australia.

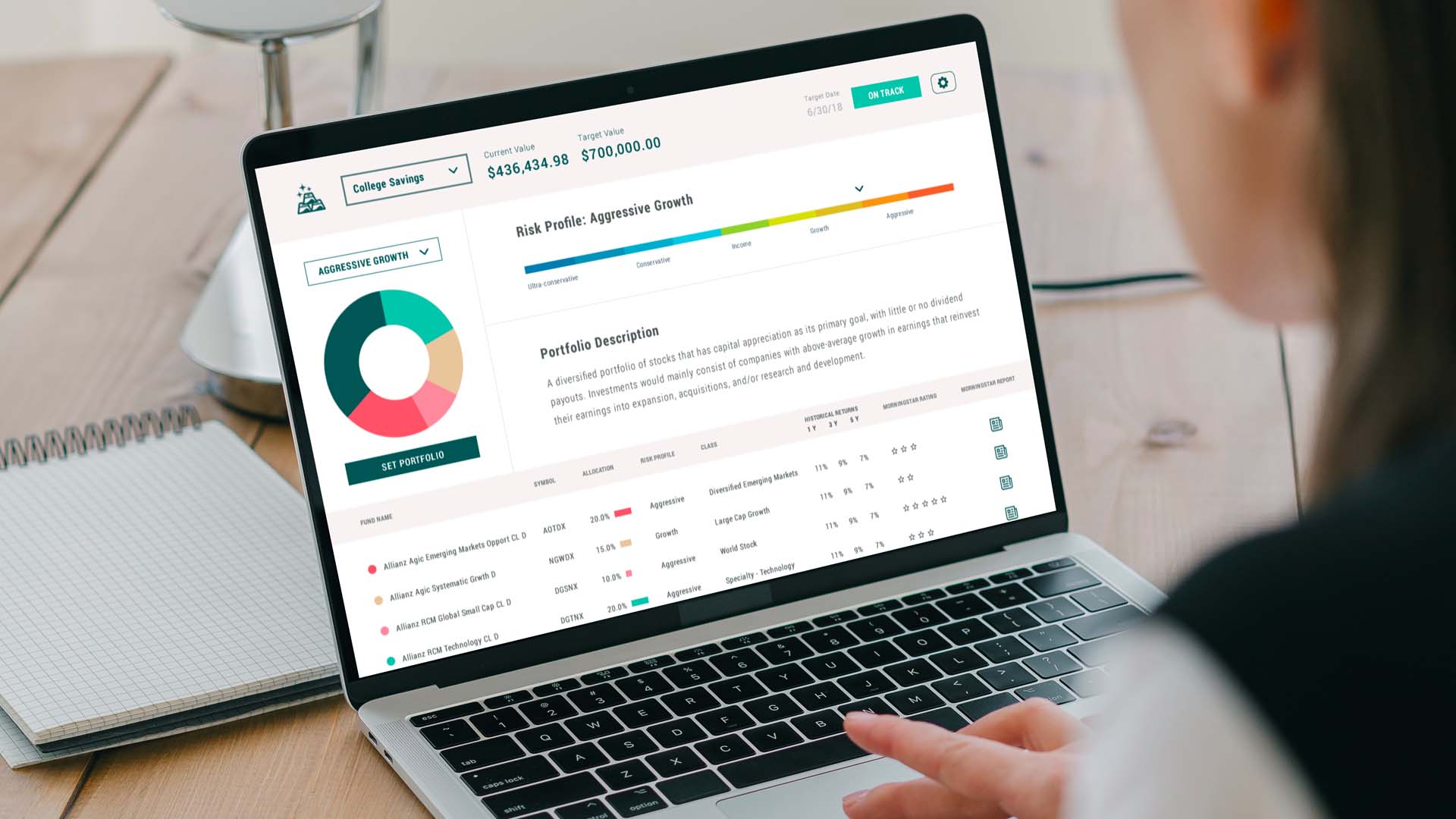

White-Label Investment and Savings Platform UI for a U.S. Investment Advisory Firm

Metasite partnered with a U.S.-based fintech startup that provides white-label digital investment advisory solutions for large financial and non-financial enterprises.

Tasked with building a user-friendly frontend application, Metasite created an investment advisory platform UI featuring goal-oriented investment and savings plans, supported by intelligent investment decisions tailored to individual risk profiles.

Engaging Metasite has enabled Man to cut time-to-market and refocus our internal tech teams on development of core technologies strategic to Man Group. We look forward to continuing our collaboration.”

Meet our investment management solutions team

Meet a few people from our team specializing in solutions for the investment management industry:

Valentinas

Lead Business Analyst

Edvinas

Senior UI Developer

Aurimas

Project Manager

Danielius

Sr. Software Developer

Helping investment managers with cost-effective technology

For our clients in traditional asset management, hedge funds management and financial information services we have delivered a variety of custom development projects:

- Migrating legacy marketing communication websites to open-source content management platforms

- Building bespoke secure alpha capture systems

- Refactoring and upgrading legacy backend systems

- Improving availability through our reliable managed hosting services

- Helping build bespoke trade execution middleware

- Building and maintaining web and mobile platforms for secure market information delivery

- Enabling automatic feeding of prices and other information to subscribers of over 300,000 Bloomberg terminals by utilising Bloomberg’s Multi-Product Feed (MPF) communication protocol

A couple of the investment industry clients we have been serving

Man Group is one of the world’s largest independent alternative investment managers and a leader in liquid, high-alpha investment strategies, with around USD 140 bn assets under management. Since 2014 Metasite has been supplying Man with systems and applications development, maintenance and management services.

Man Group is one of the world’s largest independent alternative investment managers and a leader in liquid, high-alpha investment strategies, with around USD 140 bn assets under management. Since 2014 Metasite has been supplying Man with systems and applications development, maintenance and management services.

Man AHL is a leading quantitative investment manager and a pioneer in systematic trading for over 25 years. Founded in 1987, employing over a hundred investment professionals and over 80 researchers and headquartered in London, Man AHL manages billions of dollars in assets.

Man AHL is a leading quantitative investment manager and a pioneer in systematic trading for over 25 years. Founded in 1987, employing over a hundred investment professionals and over 80 researchers and headquartered in London, Man AHL manages billions of dollars in assets.

Vontobel is a globally operating financial expert with Swiss roots, specialised in wealth management, active asset management and investment solutions. In close collaboration with Metasite, Vontobel Asset Management is developing advanced web applications and portals to reflect the latest global trends in investment.

Vontobel is a globally operating financial expert with Swiss roots, specialised in wealth management, active asset management and investment solutions. In close collaboration with Metasite, Vontobel Asset Management is developing advanced web applications and portals to reflect the latest global trends in investment.

Headquartered in London and with branches in Hong Kong and NYC, Bond Radar is a real-time financial news service delivering fast and accurate information on the international bond and loan markets and is the preferred system for all the major financial institutions engaged in the global capital markets.

Headquartered in London and with branches in Hong Kong and NYC, Bond Radar is a real-time financial news service delivering fast and accurate information on the international bond and loan markets and is the preferred system for all the major financial institutions engaged in the global capital markets.

Arnold Dapkus

Arnold Dapkus Aldas Kirvaitis

Aldas Kirvaitis

Comments are closed.